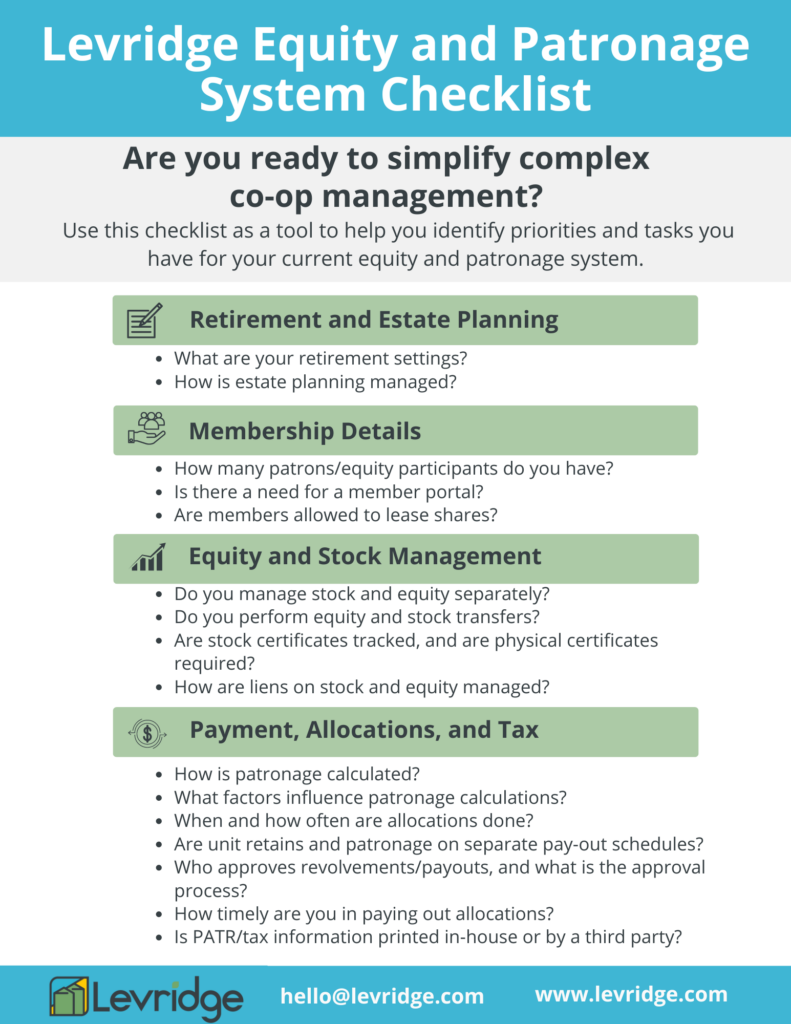

Levridge Equity and Patronage System Checklist

This comprehensive checklist serves as a guide for cooperative managers to evaluate and streamline their equity and patronage processes.

Click here to download a PDF of the Equity and Patronage System Checklist.

Retirement and Estate Planning: Securing the Future

Retirement and estate planning are crucial for the longevity and stability of a cooperative. These aspects ensure that members can retire with confidence, knowing their equity and patronage shares are managed effectively. Cooperatives need a well-defined process for managing the equity of deceased members including the transferring of shares to heirs or handling payouts in a manner that respects the member’s wishes while maintaining the cooperative’s financial stability.

- What are your retirement settings?

- How is estate planning managed?

Membership Details: Understanding Your Base

Knowing the details of your membership is fundamental to effective cooperative management and vital for making informed decisions about equity distribution, patronage dividends, and overall co-op governance.

Additionally, consider a member portal which can provide a centralized platform for members to access their equity information, review transaction history, and access tax documents.

The ability for members to lease shares can provide flexibility for members who may not want to sell their shares but need temporary liquidity. It also helps the cooperative maintain stability by keeping shares within the organization rather than forcing a sale on the open market.

- How many patrons/equity participants do you have?

- Is there a need for a member portal?

- Are members allowed to lease shares?

Equity and Stock Management: Ensuring Accuracy and Compliance

Evaluate whether you manage stock and equity as separate entities. This distinction is important for accurate accounting and ensuring compliance with both co-op bylaws and external regulations.

Equity and stock transfers are another critical area as these are particularly important in scenarios where members leave the cooperative, pass away, or transfer their interests to other members.

In today’s digital age, many cooperatives are moving towards electronic records, but physical certificates may still be required for certain transactions. Ensure that your cooperative has a clear system in place for managing these documents.

Liens on stock and equity can complicate transactions if not managed properly. Addressing these aspects of equity and stock management helps maintain the integrity of your cooperative and protects both the organization and its members.

- Do you manage stock and equity separately?

- Do you perform equity and stock transfers?

- Are stock certificates tracked, and are physical certificates required?

- How are liens on stock and equity managed?

Payment, Allocations, and Tax: Streamlining Financial Processes

The financial health of a cooperative is largely dependent on how well it manages payments, allocations, and taxes. The calculation should be transparent, fair, and aligned with the co-op’s bylaws. The frequency and method of allocations are also critical.

Unit retains and patronage may be on separate payout schedules, and this needs to be managed carefully to avoid confusion or dissatisfaction among members. Clear communication about these schedules, along with the approval process for revolvements or payouts, is essential for maintaining member confidence and ensuring smooth operations.

The timeliness of payout allocations is another key aspect. Delays in payments can lead to frustration among members and potentially harm the cooperative’s reputation.

Consider how PATR and tax information are handled. If printed in-house, ensure that your team is equipped with the necessary tools and knowledge to handle this critical task.

- How is patronage calculated?

- What factors influence patronage calculations?

- When and how often are allocations done?

- Are unit retains and patronage on separate payout schedules?

- Who approves revolvements/payouts, and what is the approval process?

- How timely are you in paying out allocations?

- Is PATR/tax information printed in-house or by a third party?

The Path to Simplified Co-op Management

The Levridge Equity and Patronage System Checklist is a strategic tool for improving your cooperative’s management practices. By addressing each section of the checklist, you can ensure that your equity and patronage systems are well-organized, compliant with regulations, and aligned with the present and future needs of your members.